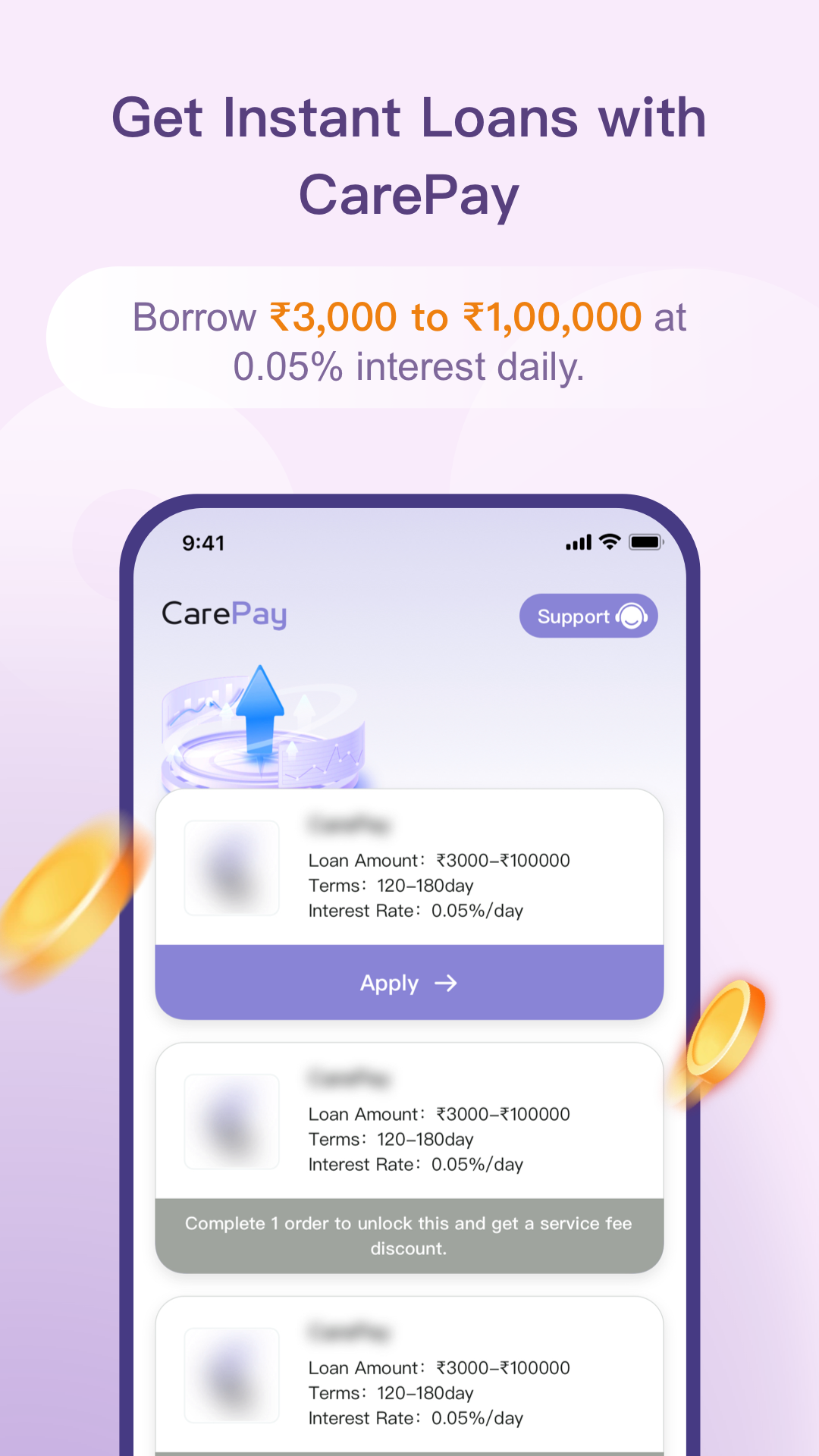

The new CarePay app makes managing personal loans and payments easy.

Increase in merchant profitability

Average approval time

Clinics reachable via partners

Yearly Transactions on platform

Lender: Findoc Finvest (P) Ltd

Lender Website: https://findocfinvest.com/

Don't let finances delay your treatment. Get instant personal loans tailored for your medical needs.

Our AI-driven engine looks beyond just credit scores to approve more patients for the care they need.

Choose repayment plans from 3 to 24 months. No hidden charges, just transparent EMIs.

Funds transferred directly to your clinic or bank account within minutes of approval.

End-to-end healthcare payment infrastructure powered by AI

Zero-cost EMI & Non-EMI split-pay; Paylink, QR, or embedded POS. TAT is 59 seconds.

Learn morePatient-first assistant that collects docs, validates, and completes LOS/LMS in chat.

Learn moreAlternative-data-aware credit/risk engine + rules studio; approvals that balance speed with safety.

Learn moreAutomated reconciliation, payouts, and ledgers matched to procedures and providers.

Learn moreEnd-to-end chat checkout in Careena with seamless payment integration.

Learn moreFour simple steps from patient onboarding to fund settlement

Careena AI collects patient information and treatment details

Real-time risk assessment and instant offers from our lender marketplace

KYC + e-mandate completed seamlessly in chat interface

Automated reconciliation and payouts matched to procedures

Enterprise-grade security and regulatory compliance you can trust

Controls in place, audits underway

Data encrypted in transit and at rest

Compliant PG flows with audit trails

Explicit consent and privacy-first approach